People most affected by this are families, first-time buyers, and young adults hoping to buy their first home. Many have been priced out of urban centres and pushed into smaller towns. Renters have also felt the squeeze. In some areas, they now spend over 40% of their income just on accommodation.

The fall in interest rates should help, but price increases have wiped out any benefits. In fact, foreclosures went up in the first quarter of 2025. Some families simply can’t keep up with the payments. Even though loans may be cheaper, homes are now more expensive than ever.

Is this another housing bubble like the one in 2007?

Experts don’t think so—at least not yet. Lending rules have been much tighter since the property crisis of 2008, and banks are more cautious. Still, the pace of growth has raised eyebrows. CaixaBank and other analysts expect prices to keep rising this year, but at a slower pace in 2026 as more homes come onto the market.

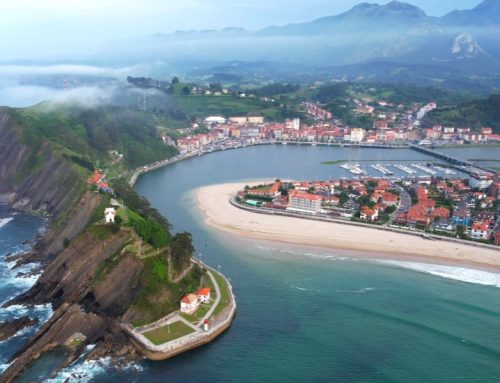

Certain areas have seen sharper increases than others. In Andalusia and Melilla, prices jumped 14%. Murcia wasn’t far behind. Even regions unstressed by mass tourism like La Rioja and Aragón recorded growth above 13%. Smaller towns on the outskirts of Madrid are suddenly popular again, especially among families on a budget.

The government has promised action, and recently announced plans to triple Spain’s social housing budget to €7 billion. Some of that money will come from the EU. The goal is to build faster and more affordably using industrial methods. Other proposals include a larger taxation on non-EU homebuyers and to limit the number of homes used for tourist rentals. However, critics argue that the Spanish government is choosing softer targets like private owners while failing to tackle the deeper issue of property speculation, creating an uneven playing field.

Critics also say these plans sound good on paper but haven’t made much difference so far. There is much talk, and much taxation, but little action. The government promised that over 244,000 public homes would be built in 2024, but by the end of 2024 only 350 new social homes had been completed! Many have called for deeper reforms and faster progress.

So what can home buyers in Spain expect in the next few years?

Most analysts agree that prices will continue to climb through to 2026, especially in high-demand zones like the coast, major cities, and tourist hotspots. Some relief may come in 2026 if more homes are built and rules around rentals tighten up.

Spain Real Estate growth continues to make news as affordability worsens and demand outpaces supply. Whether you’re a buyer, renter, or investor, it’s best that you keep a close eye on how the market develops and what real steps the government takes next. The question on everyone’s mind is “how much higher can prices go?”, and who will still be able to afford a home in Spain in a few years?